Supplements OTC Rx Consumer Trends Report

155 pages of the Institute’s research, study supported, providing current consumer insights with data and analysis, including charts, graphs, and illustrations!

Site License: Includes PDF, PPT with access to charts and site rights for internal network usage across one company BRAND/location.

Price: $15,000 Order Report

Introduction: 10+ Years of Supplements-OTC-Rx (SORD) Marketplace Insights

Natural Marketing Institute is pleased to present its 2023 Supplements/OTC/Rx (SORD) Consumer Trends Report. With 10+ years of trended data, this report provides the most comprehensive view of how the supplement landscape has changed, along with the most recent and updated information on how consumers think and behave about supplements, prescription drugs, and over-the-counter medications.

This one-of-a-kind report also provides insights into how today’s consumers are confronting their health and wellness and uncovers the health challenges they face.

The overall objectives of the report are to develop unique and specific consumer insights to maximize client learnings and opportunities in attracting new consumers, increasing compliance, and developing compelling messaging and communications strategies.

Table of Contents

Database Overview

Other Natural Marketing Databases Used

Definitions of Groups

Introduction

Executive Summary

Four Step Model for Driving Supplement Growth

What is Trending

Health & Wellness Consumer Segments

Natural Marketing Institute's Consumer Segmentation Methodology

Segment Overview

WELL BEINGS Snapshot

FOOD ACTIVES Snapshot

MAGIC BULLETS Snapshot

FENCE SITTERS Snapshot

EAT, DRINK & BE MERRYS Snapshot

Importance of Daily Supplementation

Supplement Use for Condition Management

Supplement Quality vs. Price

Preference for Organic and Natural

Health & Wellness Nielsen Overlay Methodology

Nielsen's Dollars Per Buyer Index: A Segment Sample

Health & Wellness Composition of Supplement Groups

Demographic Profile of Health & Wellness Segments

Understanding the Supplement Landscape: What's Changing

Importance of Supplementation for Health

Changing Demographic Profile of Supplement User

Perceived Nutrient Deficiencies

Supplement Use as Dietary Assurance

Supplement Category Growth Trends

Detailed Supplement Category Growth Trends

Growth in Current, Lapsed and Non Supplement Users

Reasons for Non-Use

Current Use Trended across Generations & Ethnicities

Profile of Generational and Ethnic Supplement Users

Shifts among Light, Medium & Heavy Supplement Users

Use of Specific Supplements

Growth in Use of Specific Supplements

Use of Specific Supplements across Generations

Use of Supplements: Increased, Decreased, Stay the Same

Impact of Inflation on Supplement Category Use

Impact of Inflation on Purchasing Behaviors

Reasons for Increased Supplement Use

Concerns when Taking Supplements

Concerns when Taking Supplements across Generations

Top 3 Concerns When Taking Supplements: Generational Detail

Interest in Personalized Supplements

Supplement Dynamics: Building Loyalty

Preference for Other Supplement Formats

Preference for Other Supplement Formats by Generation

Preference for Edible Formats

Supplement Formats Preferred

Ranked Formats: 2011 and 2022

Ranked Formats by Generation

Important Attributes Toward Supplement Purchase

Growth in Importance of Attributes

Concern Over Nutrient Bioavailability and Absorption

Preference for Organic or Natural Sourcing

Preference for Sustainable Ingredients

Preference for Plant-Based Supplements

Recognition and Understanding of Certifications

Lack of Recognition of Certifications

Impact of Certifications on Likelihood to Purchase

Impact of Certifications on Likelihood to Purchase by Generations

Sources of Influence on Supplement Purchase

Physicians' Influence on Supplement Use

The Herbal Landscape

Trended Use of Herbal Supplements

Average Daily Supplement Use among Herbal Users

Use of Supplement Categories by Herbal Users Use of Specific Herbal Supplements

Use of CBD /Hemp Trended

Importance of Sustainable Sourcing among Herbal Users

Important Attributes of Supplement Purchase among Herbal Users

Supplement Brand Use among Herbal Users

Use of Algae and Seaweed

Reasons for Use of Medicinal Mushrooms

Body Systems and Health Connections

Use of Supplements for Health Management

Condition Managers' Discussion of Supplement Use with Physician

Likelihood to Use Supplements for Specific Conditions

Growth in Likelihood to Use Supplements for Specific Conditions

Condition Management (37 conditions)

Top 10 Conditions Managed- Trended

Growth in Conditions Managed: 2020-2021

Top 10 Ranked Conditions across Generations

Likelihood to Use Supplements Plotted against Conditions Managed

Likelihood to Use Supplements among Niche Condition Managers

Level of Concern about Preventing Conditions

Growth in Concern about Preventing Conditions

Concern about Preventing Conditions among Generations

Concern about Preventing Conditions During Pandemic Years

Concern for Prevention Plotted against Conditions Managed Management vs. Concern for Prevention of Immune Issues-Trended

Reasons for Increased Supplement Use among Immune Managers

Methods Used to Manage Immune Issues

Effect of COVID-19 on Management of Emotional Issues

Management of Emotional Issues-Trended

Management of Emotional Issues by Immune Issues

Management of Emotional Issues by Generations

Purchase of Supplements to Manage Stress due to Inflation

Attitudes Surrounding Brain Fitness

Methods Used to Manage Brain Fitness

Management of Digestive Issues

Methods Used to Manage Digestive Issues

Methods Used to Manage Lack of Energy

Methods Used to Manage 35 Different Issues (1)

Methods Used to Manage 35 Different Issues (2)

Ranked Order of Conditions by Method Used to Manage

Growth in Supplement Use for Condition Management

Growth in Non-Use of Any Method to Manage Conditions

Preference for a Supplement Remedy over an Rx or OTC

Pathways to Purchase

Channels Shopped for Supplements & Growth in Channels Shopped

Channels Shopped Most Often

Supplement Sourcing Preferences and Brand Loyalty by Internet Shoppers

Mass Merchandiser Shopping by Demographic Groups

Impact of Inflation on Supplement Use by Channel Shoppers

Growth in Grocery Shopping by Demographic Groups

Attitudes Regarding Store Brands by Brand Users

Brand Loyalty vs. Price

Monthly Spending on Supplements

Monthly Spending on Supplements by Channel & Retail Shoppers

Retailers Shopped for Supplements

Use of OTC and Prescription Medications

Types of Over-the Counter Medications Used & Growth

Use of Sleeping Aids-Trended

Use of Digestive Remedies-Trended

Use of Decongestants, Cough & Cold Remedies-Trended

Use of OTC Medications by Condition Managers

Concerns about OTC Medications

Conditions for Which a Prescription Medication is Used

Use of Prescription Medications by Condition Managers

Concerns about Prescription Medications

Physicians' Involvement with Prescribing Medications

Monthly Spending on OTC and Prescription Medications

The Institute's Health and Wellness Segmentation Model Methodology

Development of the Institute’s Health & Wellness segmentation model began in 2009 with evaluating over 515 different attitudinal and behavioral variables, later narrowed to approximately 19.

A k-means clustering method was used. Cluster centers were defined as dense regions in the multivariate space based on a k-means segmentation of the attitudinal and behavioral variables from the Institute’s Health & Wellness Consumer Trends Database survey.

- Health and Wellness segmentation can be used to identify and predict segment membership as part of a quantitative extrapolative analysis of future consumer behavior.

- 5 Unique Segments: each segment is mutually exclusive and is designed to have the maximum differentiation between consumer groups and the maximum homogeneity within each consumer group. The predictive accuracy is high at 92.2%.

- The segmentation has been overlaid on third-party data sets such as Nielsen’s Homescan and can be used through the Institute in custom/primary qualitative or quantitative research.

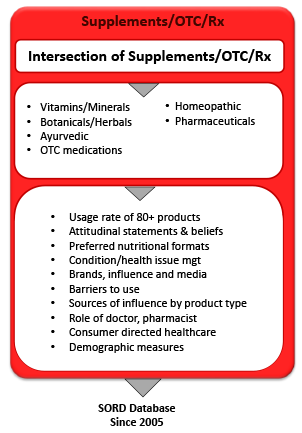

Supplements-OTC-Rx Database (SORD) and Report Methodology

- Most comprehensive data and robust data collection vehicle available which examines the intersection of dietary supplements, OTC, and pharmaceuticals

- Ongoing consumer research among U.S. general population adults

- Nationally representative sample of the U. S. population statistically valid at 95% confidence level to +/- 1.2%

- Research previously conducted and trended in USA in 2006, 2009, 2011, 2013, 2015, 2017, 2018, 2020, 2021

- 2022 research was conducted among 3,012 general population consumers and conducted in 4th quarter 2022

- Conducted via on-line methodology

- Trended research also conducted globally in 13 countries

Contact Us for more information on our 2023 Supplements-OTC-Rx Consumer Trends Report